Sports Gambling Investment Fund

The Supreme Court of the United States lifted the federal ban on May 14, 2018. Since the ruling, 19 states have passed bills legalizing sports betting, including Colorado, North Carolina and Illinois.

In total, today, there are 42 states in various stages of legalizing sports betting.

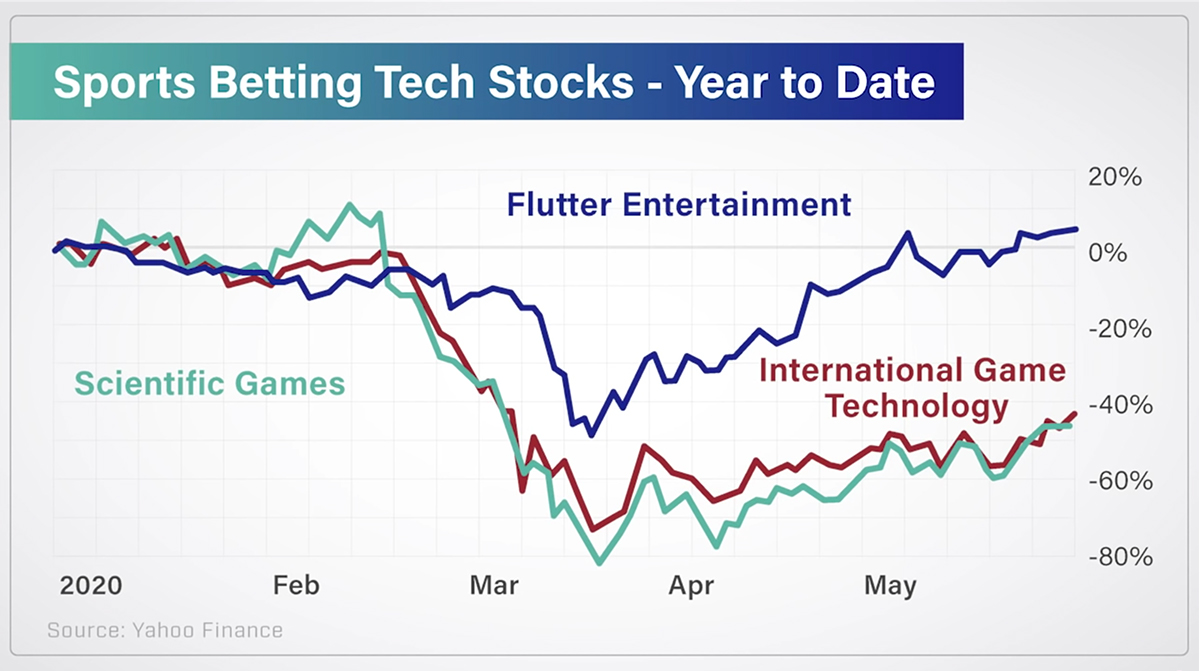

With more and more states passing bills, the market is expanding at an unprecedented pace. And some deals have taken place and funds launched in the country.

The Roundhill Sports Betting & iGaming ETF (BETZ) debuted Thursday as the first exchange traded fund focusing on the sports wagering and internet casino segments – two of the fastest-growing. Entity sports betting is being touted as a viable, legitimate investment by some outfits that supposedly operate on the same principles as mutual funds. These outfits assert that a sports wager is. Sports betting as an investment is a better option than traditional investing methods for a variety of reasons. First, and perhaps most importantly, sports betting is a great investment because of.

Below, we feature some meaningful operations.

One of the most important deals was the agreement between The Stars Group Inc. (Nasdaq: TSG)(TSX: TSGI) and Fox Sports, a unit of Fox Corporation (Nasdaq: FOXA, FOX), which launched Fox Bet, a national media and sports wagering partnership. Its two first products are:

– a nationwide free-to-play game, awarding cash prizes to players who correctly predict the outcome of sports games, and

– Fox Bet, which will give customers in states with regulated betting the opportunity to place real money wagers on the outcome of a wide range of sporting events in accordance with the applicable laws and regulations.

Sports Betting Investment Fund

Another important deal tool place in November 2019, with global sports betting company William Hill acquiring the sports book assets of CG Technology, including its Nevada and Bahamas operations. Led by Parikshat Khanna, CEO, CG Technology is one of the largest licensed bookmakers in Nevada and operator of seven Nevada sportsbooks at six prime Las Vegas resorts.

In addition, a wave of innovative startups is emerging with products, services, and solutions designed to tap the estimated $17 billion dollar opportunity that legal U.S. sports betting represents.

And some deals have alreasy taken place, including the following ones:

– in February 2019, The Action Network, a Los Angeles, CA-based sports media company that provides in-depth betting content, tools and analytics for sports fans, closed on $17.5m in Series B funding. Launched in January of 2018 by Patrick Keane, CEO, the company provides premium storytelling and analysis, real-time odds, in-depth information on betting websites which feature offers (e.g., like Maxfreebets Bet 10 Get 30) and markets, personalized alerts for users, as well as the ability to track bets via its website and sports app. The mobile application, available for free on iOS and Android, also allows users to track bets, receive alerts corresponding to picks and see how much money is placed on each side of every wager; and

– in October 2019, ZenSports, a San Francisco, CA-based mobile peer-to-peer sports betting marketplace where anyone can create and accept sports bets, raised $675K in seed funding.

ZenSports is a decentralized marketplace, which enables bettors to create their own bets with their own odds and terms, or accept bets that others have created. The company has also created its own cryptocurrency utility token called SPORTS, which customers can use for placing bets, earning discounted betting fees, and getting cash back, bonuses, and other rewards.

Sports Gambling Investment Funds

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/8806503/Stratagem___Andreas_Kourkorinis___Founder_and_Head_of_Trading_7.jpg)

With this emergence of the trend, specialized venture capital firms approaching the industry, as well.

Among others, dedicated funds include:

– Sports Gaming Investment Fund (SGIF), which is focused on startups that support the emerging U.S. market for legal sports betting; and

– Vice Ventures, a fund dedicated to investing in “vice” industries.

The Securities and Exchange Commission today announced fraud charges against two individuals and six entities relating to an ongoing, Nevada-based $29 million sports betting investment scheme impacting over 600 investors from more than 40 states, as well as other charges against three individuals and a company who sold investments.

The SEC's complaint alleges that convicted felons, John F. Thomas and Thomas Becker, and several entities they control, promised investors 250% to 600% returns from pooled investments in sports betting, using what they claimed was a proprietary handicapping system. The complaint, however, alleges that they used the majority of investor money to fund their lifestyles, pay commissions to brokers and agents, or make Ponzi-like payments to other investors. The complaint further alleges that they misrepresented to investors the investment performance of the funds that were actually invested in sports betting. The complaint also alleges that Douglas Martin, Paul Hanson, Damian Ostertag, and a company owned by Martin sold unregistered securities without being registered as brokers or associated with a registered broker.

The SEC's complaint, which was filed in the United States District Court for the District of Nevada on August 30, 2019, charges Thomas, Becker, Einstein Sports Advisory, LLC, QSA, LLC, Vegas Basketball Club, LLC, Vegas Football Club, LLC, Wellington Sports Club, LLC, and Welscorp, Inc. with violating the antifraud provisions of Section 17(a) of the Securities Act of 1933 ('Securities Act') and Section 10(b) of the Securities and Exchange Act of 1934 and Rule 10b-5 thereunder, and the registration provisions of Section 5(a) and 5(c) of the Securities Act. The complaint also charges Martin, Hanson, Ostertag, and Executive Financial Services, Inc. with violating the broker-dealer registration provisions of 15(a) of the Securities Act and the registration provisions of Section 5(a) and 5(c) of the Securities Act.

The SEC's investigation was conducted by Matthew Montgomery and Deborah Russell, and was supervised by Robert Conrrad. The SEC's litigation will be handled by Lynn M. Dean and Matthew Montgomery, and supervised by Amy Longo.